Colorado has started to shrink its housing deficit, but affordability issues persist, state demographer’s office says

The state’s housing deficit has gone from a peak of 140,000 in 2019 to 106,000 in 2023, but prices continue to outpace wage growth

Robert Tann/Summit Daily News

Slower population growth and increased development have begun to chip away at Colorado’s housing gap, according to a new study from the State Demography Office.

The study, released on Wednesday, Sept. 17, analyzed Colorado’s housing landscape as of 2023, the most recent data year available. It found that the state needed approximately 106,000 homes to meet demand, down from a peak of 140,000 in 2019.

Between 2020 and 2023, Colorado saw an average of 43,000 new housing units each year, outpacing the previous decade and helping reduce the state’s housing shortfall by nearly 25%, according to the report.

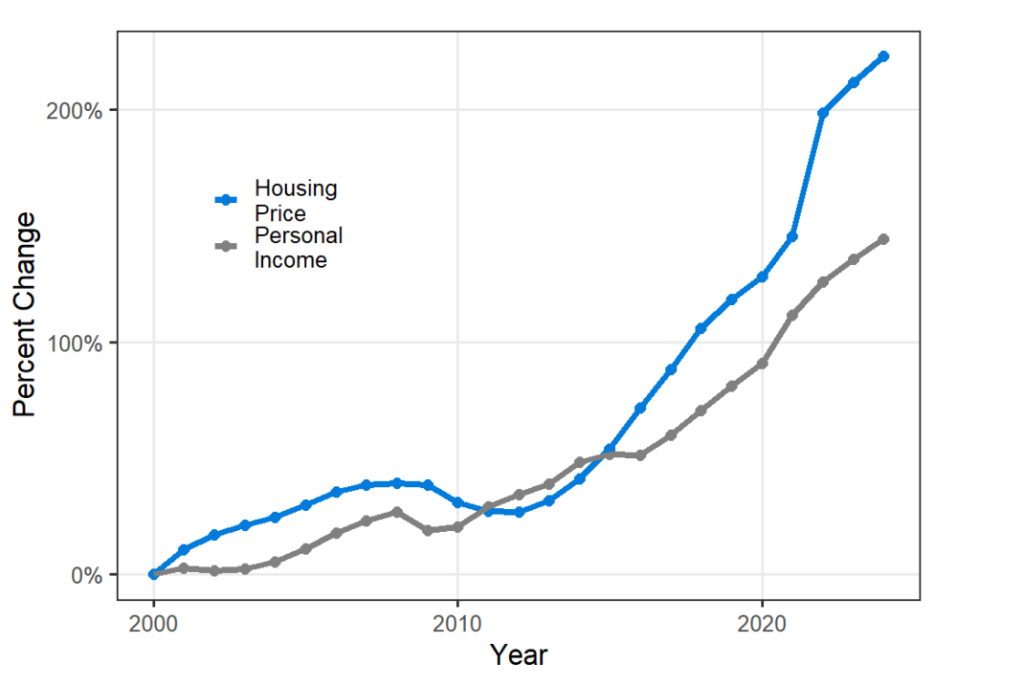

However, it also notes that, since 2023, the state’s housing market has seen increased interest rates, insurance and construction costs, which have helped drive home prices higher. Housing prices over the last decade have also continued to outpace wage growth.

As of 2023, home prices were up 223% compared to their values in 2000, and rents rose 164%, while personal income only increased 144%. Overall, 2023 saw the largest housing affordability gap on record since 2000, according to the report.

More recently, Gov. Jared Polis raised alarm over what President Donald Trump’s tariffs will mean for the housing market.

In a report released by Polis’ budget office earlier this month, it found that the number of housing construction permits for the first half of 2025 was slightly lower than expected. That report also projects that tariffs on building materials, like lumber, steel, aluminum and copper, will increase construction costs for new homes by 4% to 6%.

“We are fighting to lower housing costs and ensure that every Coloradan can realize the dream of becoming a homeowner, but more work needs to be done,” Polis said in a statement announcing the release of the demographer’s report. “By expanding housing options, we can lower costs and provide more options for Coloradans to live where we want to live.”

Sen. Dylan Roberts, a Democrat representing mountain communities in the state legislature, said overall, the demographer’s report is positive for the state “because it shows we’re going in the right direction — we’re chipping away at our housing needs.”

Housing affordability has been a top priority for Polis and state lawmakers, who’ve enacted a suite of housing-related policies in recent years. That includes funneling over $500 million into affordability programs using money from the American Rescue Plan Act, a 2021 federal COVID-relief law.

But some of the most sweeping legislative measures, such as a 2024 bill requiring more housing density in populous Front Range cities, have only just started to go into effect. Other major efforts, like a 2025 bill that aims to boost condominium development by reforming construction defect litigation laws, won’t be implemented until next year.

The state also has, for the first time, a dedicated fund for affordable housing following the passage of Proposition 123 in 2022. The fund is projected to generate, on average, more than $300 million a year for grant and loan programs to finance new housing opportunities, but dollars only started to trickle into communities in early 2024.

Roberts said he expects the impact of those policies to show up in future housing studies. He added that state funds, like those generated from Proposition 123, will also help bolster the amount of lower-cost housing for members of the workforce.

“We’re starting to see those projects either break ground or even cut ribbons on opening those homes to individuals and families,” Roberts said. “You can look around at my district here in the mountains and see those projects getting underway or completed.”

The demographer’s report does not identify or make recommendations on specific affordability measures, but says that existing research “demonstrates the need for housing targeting affordability specifically.”

It goes on to say that despite making “substantial improvements in the state’s housing deficit over the past five years,” the gap between household income and housing costs is greater now than ever before and disproportionately impacts low-income households.

The report recommends that further research be done to examine housing shortages based on area median incomes. It also notes that Colorado has a range of distinct communities, from urban to suburban to rural and resort areas, and calls for regional analyses to account for differences in housing shortages across the state.

The report gives the example of analyzing the impact of short-term rentals, second homes, and/or vacation homes on housing availability and affordability.

Colorado lawmakers in 2024 did approve a bill requiring local communities to conduct local and regional housing studies. Those studies must be published before the end of 2026 and updated every six years.

Support Local Journalism

Support Local Journalism

As a Summit Daily News reader, you make our work possible.

Summit Daily is embarking on a multiyear project to digitize its archives going back to 1989 and make them available to the public in partnership with the Colorado Historic Newspapers Collection. The full project is expected to cost about $165,000. All donations made in 2023 will go directly toward this project.

Every contribution, no matter the size, will make a difference.